Venmo

Venmo is appealing for many users who need to make payments due to its quick and easy appeal, though it’s not a money transfer service per se. While most services that allow you to send or receive cash don't involve too much in the way of legwork, Venmo has pulled in a lot of users who like its simplicity and social edge. Central to the process of sending money is its excellent app, while the money transfer service also has the added benefit of being owned by PayPal.

- Want to try Venmo? Check out the website here

As a result, Venmo comes with plenty of the latest features that make it a great digital wallet-style accompaniment to have on your phone, allowing you to pay for purchases on the go. In addition, there’s the social aspect of Venmo that has been integrated into the service, with the ability for users to share updates about their purchases to contacts. If you frequently spend money as part of a group of friends, for example, Venmo is ideal.

Similar products worthy of investigation include WorldRemit, Azimo, Western Union, PayPal and Zelle.

Pricing

Costs to use Venmo have been kept simple and straightforward, with no monthly or annual fee to worry about. If you’re going to be paying using a credit card to carry out the transaction then expect a 3% fee. Another potential cost is the 1% charge that comes from moving money out of your Venmo account and into a bank account if you don't want to wait for its regular one to three day schedule. Other than that though, Venmo delivers a plain and simple payment option.

Features

While Venmo is owned by PayPal they’re both quite different, with the former being a much more practical day-to-day solution for many more minor purchases. PayPal is obviously handy too, but it’s often used for bigger payments or transfers. Venmo is billed as offering ‘fast, safe, social payments’ and that’s really the appeal of the app summed up right there.

Wherever you and your phone goes you can tap into Venmo’s handy payment toolbox to pay for things, shop with ease and also send money to family or friends. Different settings allow you to change who can see your activity too, including Public, Friends and Private, which is useful if you have a small circle of people who perhaps all contribute to bills and need to be kept in the loop.

Students, for example, who maybe share accomodation will find Venmo useful for paying into utility bills and suchlike. Venmo has that strong built-in social aspect too, making it similarly appealing for those of us who are constantly connected. Better still is its use of QR codes to help you make payments faster and to the right person.

Performance

You’ll find that using Venmo in its app incarnation, either for iOS or Android will perform as expected. Having the substantial clout of parent company PayPal obviously means it’s been well engineered. You can also use the service via a web browser, so all in all Venmo can be called upon in a variety of different environments from home, work, hotels or on the move.

Venmo actually seems to work better the more social you are with it. For example, if you connect with your friends who also use it through Facebook you get the benefit of being able to spend more money.

Ease of use

You certainly can't fault Venmo for its instantly appealing ease of use. Simply install the app, get yourself registered and away you go. You can sign up using your Facebook account if preferred. Otherwise, it’s just a case of filling in the usual kind of details, such as name, email, mobile number and you’ll need a password.

Central to the way Venmo works is to have a bank account connected to your profile, and Venmo helps you navigate this admittedly straightforward step with ease. Debit card or bank account details will need to be input, or you can add a credit card.

Paying for things, paying someone else or indeed asking for money from an acquaintance is fuss-free with a tap of the Pay or Request buttons. A couple of steps and you’re sorted. Even if you're not friends with someone on Facebook you can use Venom Codes to pay them if they’re with you in the flesh.

Support

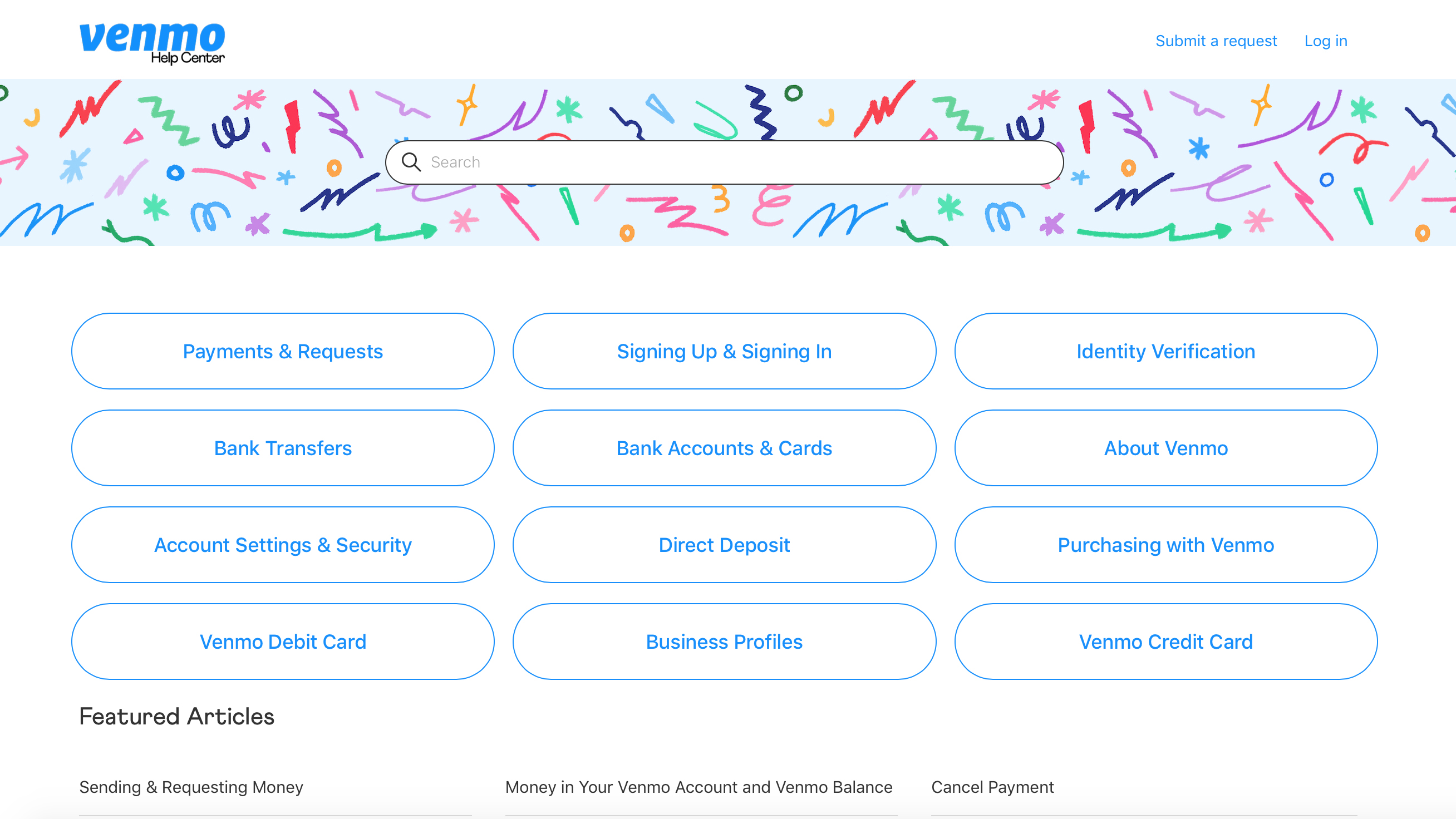

There’s an extensive help hub online to get you through most if not all of the aspects of Venmo, with similar assistance at hand if mobile is your preferred route. It’s possible to contact support via email, using the app or via forms on the Venmo website. Adding to the social aspect of the Venmo experience is the option for chatting with staff between Monday to Friday from 7am-1am EST and Saturdays and Sundays from 9am-11pm EST.

Final verdict

Venmo has heaps of benefits, especially for people who are well-versed in using their phones for all kinds of transactions. The app has been nicely put together and offers speedy payments in all kinds of scenarios. Venmo will be perfect for many who need to pay for a coffee on the go, or settle up with a family member or friends.

The service is less useful if you’re looking to making international transfers or payments as it can't currently be used for that. Users should also keep a keen eye on security settings. If you're not on top of Venmo’s privacy options you might have more on show to world than you realize.

That said, Venmo does have the benefit of PayPal’s security technology and systems behind it. All in all then, there’s lots to like about Venmo, especially if you have a close-knit group of friends who also have the app and tend to share a lot of costs when you socialize.

- We've also highlighted the best money transfer apps

Comments

Post a Comment