Money Dashboard finance management

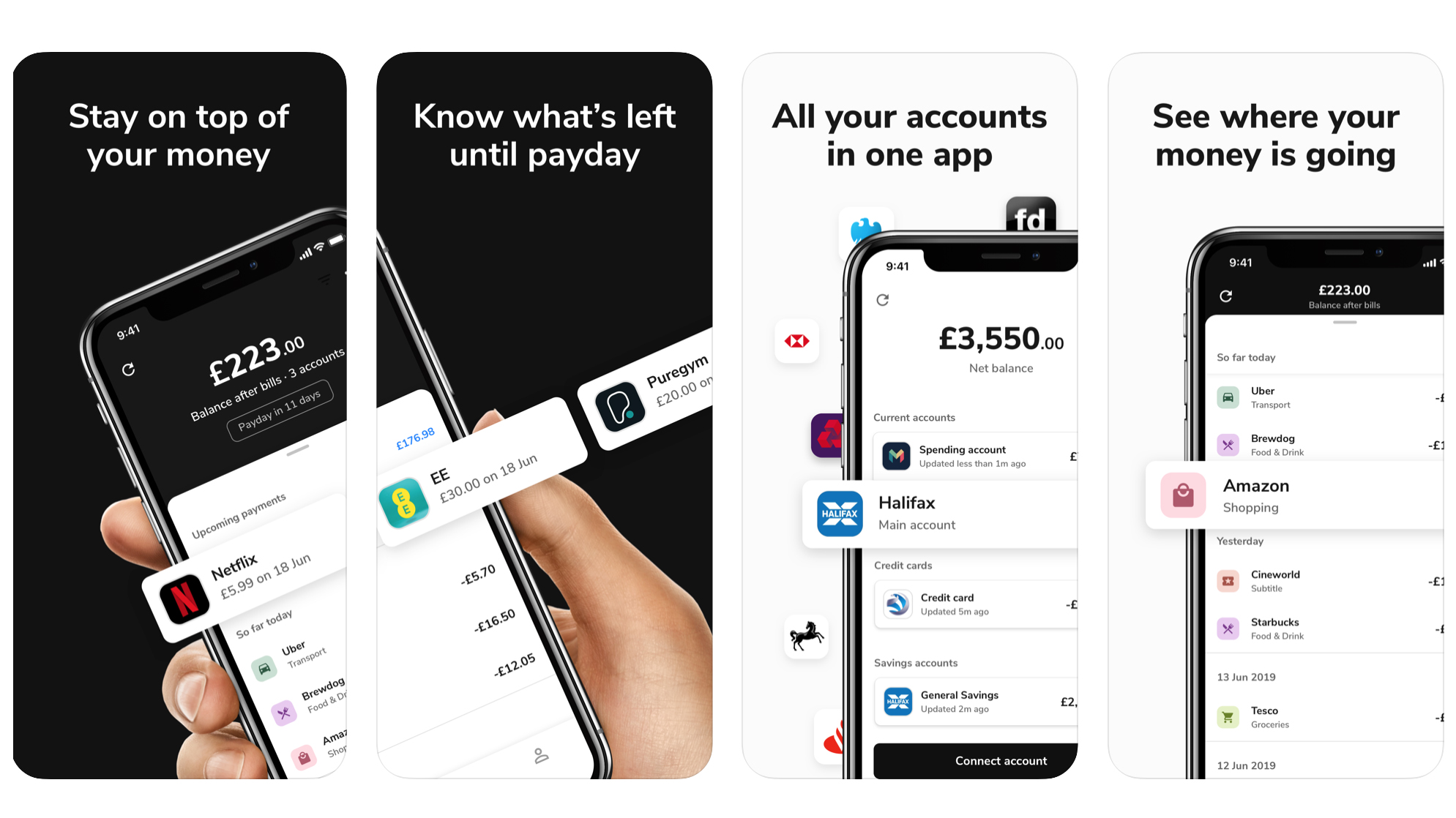

Money Dashboard is a UK-based free to use online service for personal finance that lets you connect to all of your financial interests in one place using Open Banking APIs.

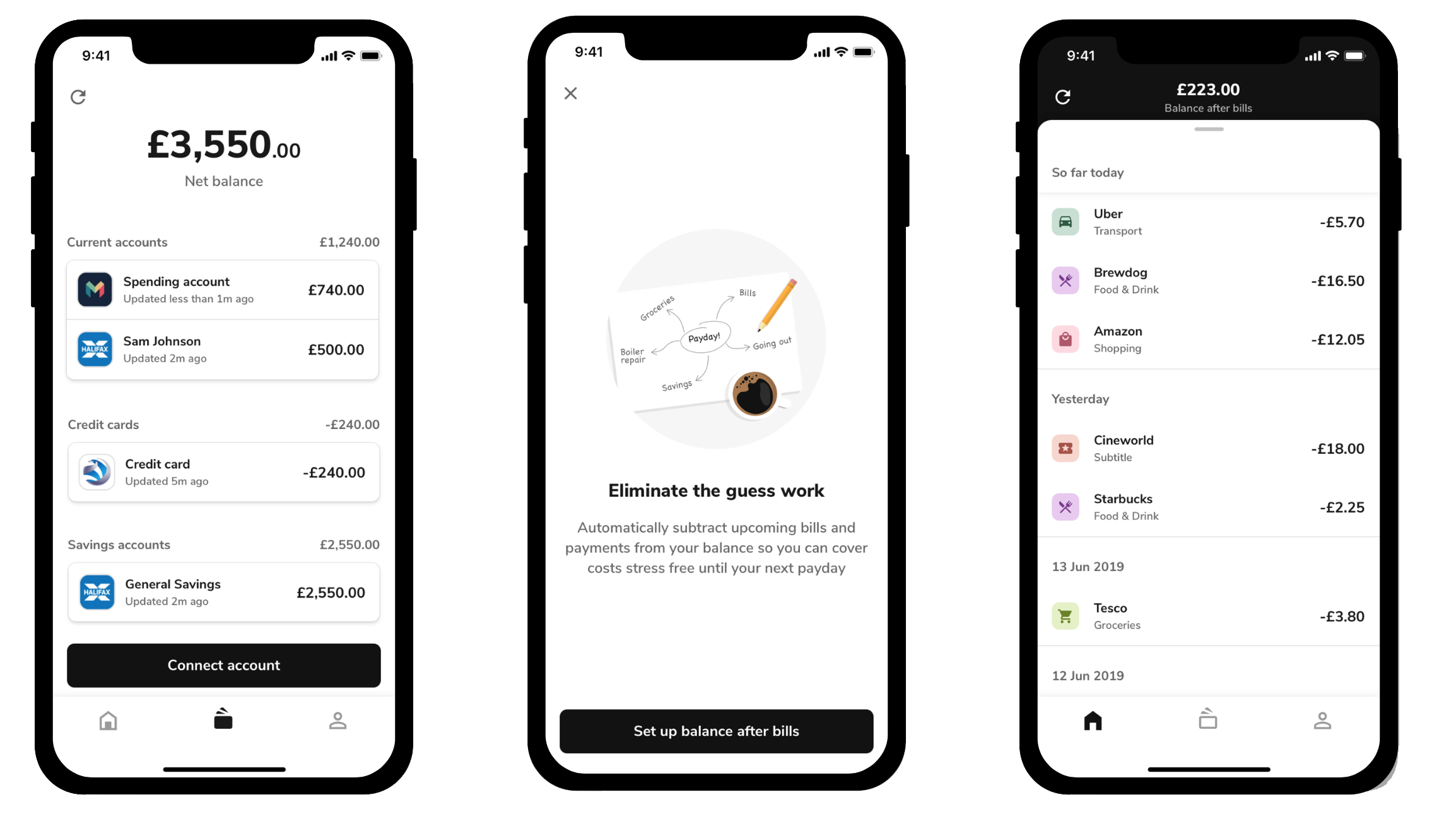

By linking accounts it allows you to keep tabs on online current and saving accounts, along with credit cards and store cards too, from one central location. Money Dashboard has recently unveiled Neon, which is a newer and more advanced product that it says will allow customers to enjoy more benefits from the growing use of Open Banking technology that the original idea was based on.

While Money Dashboard does connect you with your finances it doesn’t allow you to move money around, but does use 256-bit encryption and biometric security on the app to keep access to your data secure. If you’ve got quite a lot of accounts and want to keep better track on how they're all behaving then Money Dashboard is a useful tool, especially during the coronavirus pandemic.

Comparable personal finance options include Mint, You Need a Budget (YNAB), AceMoneyLite, Money Dashboard or Moneydance if you want to check those out too.

- Want to try Money Dashboard? Check out the website here

Features

The whole point of Open Banking is to make our lives easier, which is why there have been numerous apps and services that have appeared that allow you to do just that. Money Dashboard makes great use of the Open Banking philosophy to help you better manage your money. It’ll work quite happily through a web browser as well as on iOS and Android devices.

The accompanying app is perfect if you want to get an overview of your money on the go. Money Dashboard currently supports connecting to many well-known financial providers including the major high street names. Once you’re registered and have created an account you effectively use the service to plug-in to all of these and Money Dashboard subsequently allows you to view all of that information within its dashboard area.

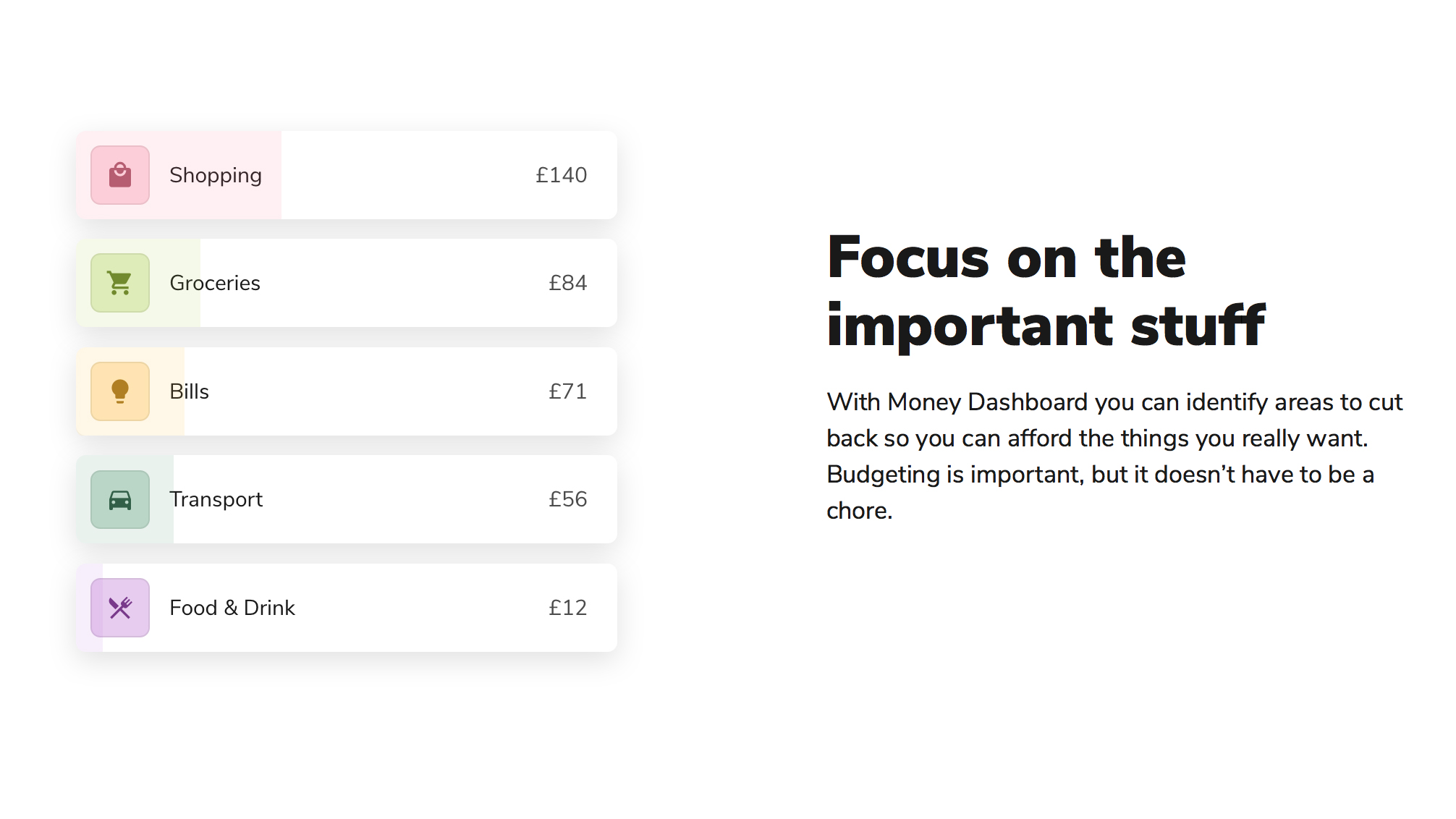

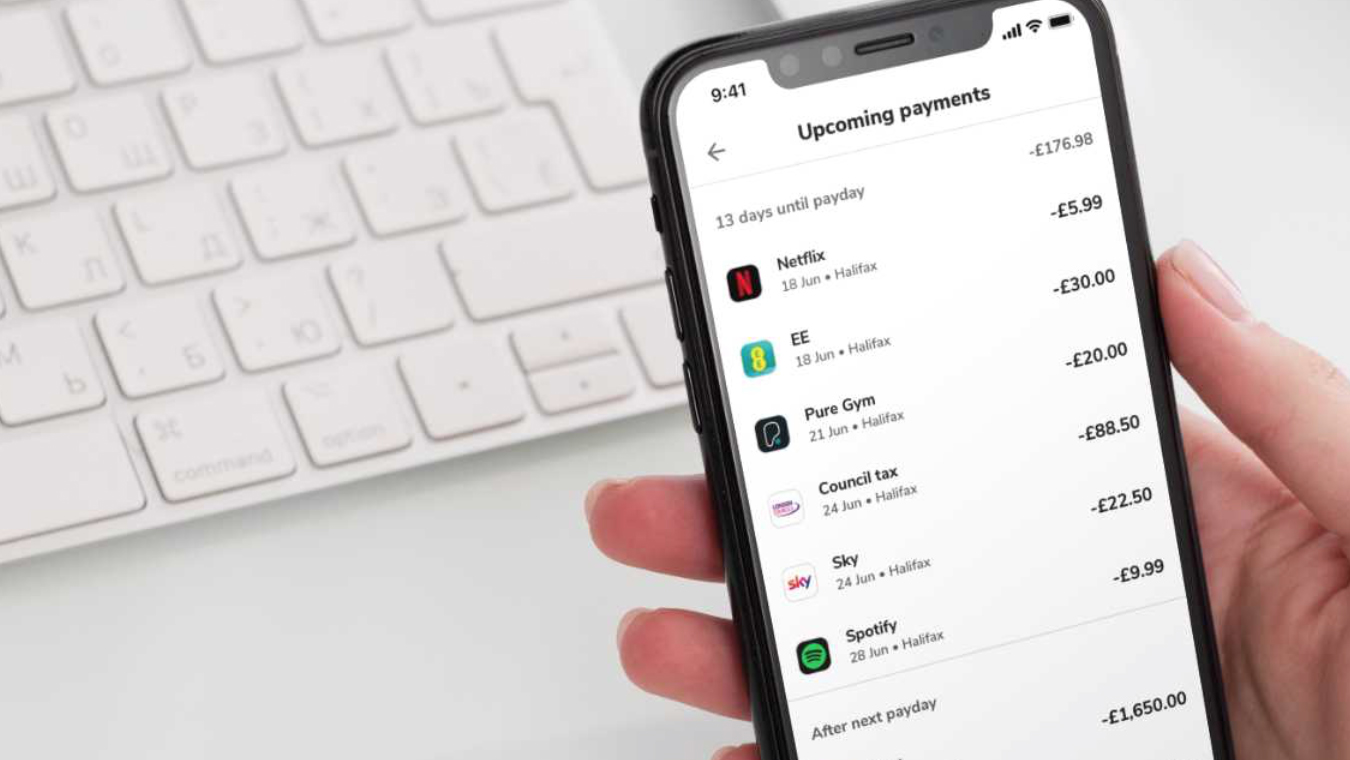

There are tools within the service that let you monitor incomings and outgoings, but it's the financial management options that will prove to be really useful if you need to keep on top of your finances. The budget planner, for example, is ideal to work out future spending based on what you’ve spent in the past.

Performance

By and large Money Dashboard turns in a decent performance, no matter if you’re using the mobile app or prefer to work your way around your finances via the desktop edition. There are some minor gripes, with a bit of lag experienced when updating accounts and recent transactions made don't seem to appear instantly in your account overview.

Nevertheless, general use is enjoyable enough, the site and app are well designed and visually appealing while the setup process proves to be as swift as you could hope for.

Ease of use

Getting started with Money Dashboard requires very little effort. All you need to do is create an account, either via the web app or by installing the mobile app on your device. Securing your account, as you’d expect from a service such as this that links to your financial interests, is also straightforward.

As for the linking accounts part of the equation then Money Dashboard makes this similarly simple. Following the sign up procedure Money Dashboard gives you a selection of UK bank account providers, so it’s just a case of selecting your options and then following the steps needed to connect to them.

Once you’ve done that it's essentially the same process for any other bank accounts you wish to add, as Money Dashboard allows you to add as many as you want if they’re available. Successive visits require you to log in each time, but that’s about it, making Money Dashboard fuss free.

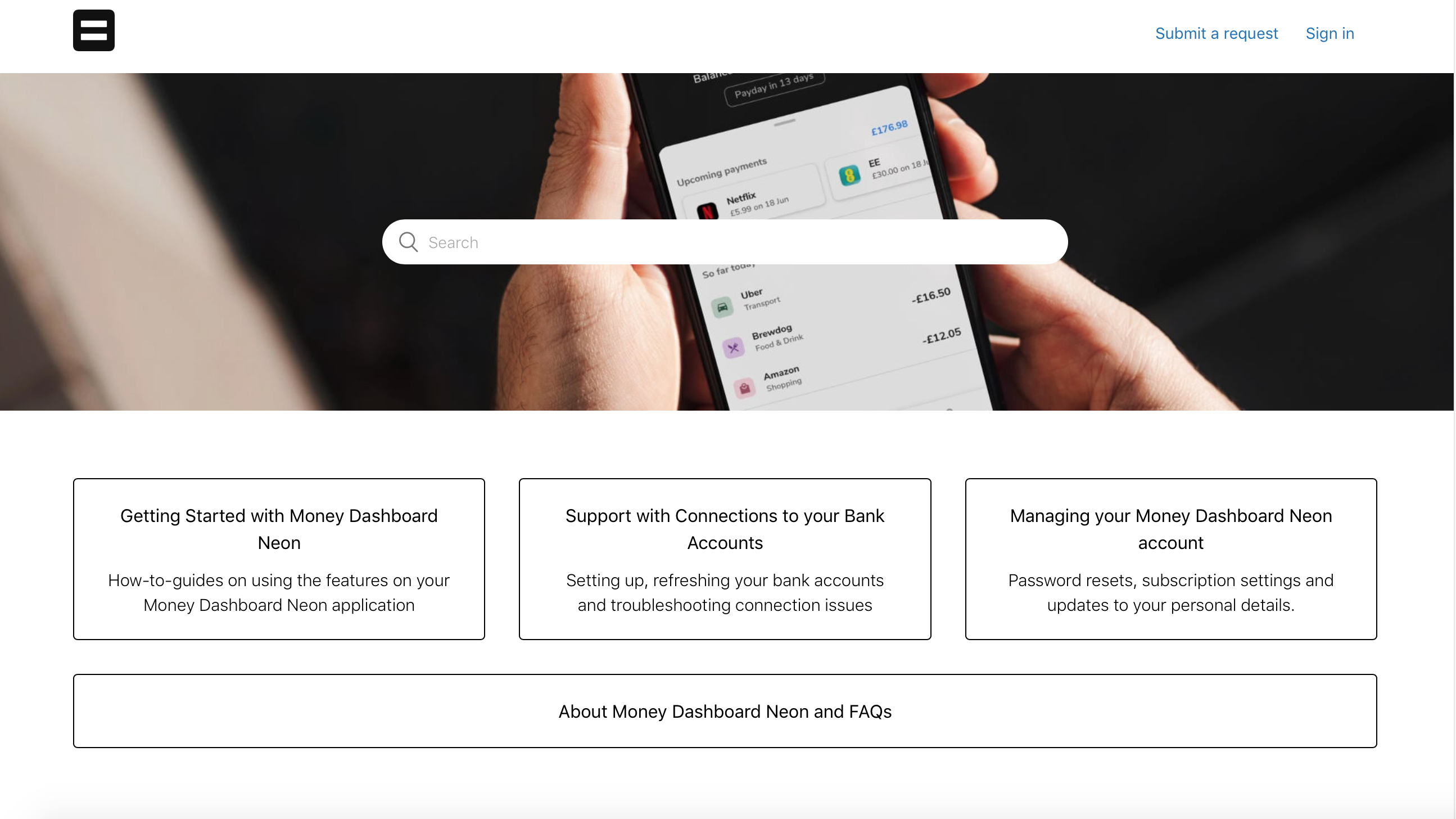

Support

Overall there’s quite a lot of support available for Money Dashboard. For more obvious issues and queries you simply need to head to the support dashboard. There’s also a dedicated support area, which lets you raise a ticket if you’ve got a problem that can't be resolved using any of the online resources.

Money Dashboard comes with a decent community area too, which is always useful for tapping into what other users frequently experience and can often give you the answer to your query in no time.

Final verdict

Many of us have multiple online bank and credit card accounts, which can prove time-consuming if you frequently need to dip in and see how your finances are faring. Money Dashboard alleviates the faffing around to a good degree, with instant access to all of your funds via one location. There are practical tools that allow you to tag areas of interest, and forecast budgeting requirements for the future.

However, you still need to go into each bank account in order to make changes to your money. While Money Dashboard is registered and authorized by the FCA and therefore secure, not everyone wants to have their data shared with data research companies, so this aspect of the service will be an issue for some people.

It’ll be interesting to see how Money Dashboard’s new Neon product will fair alongside the very impressive ‘Classic’ edition that’s most well known.

- We've also highlighted the best tax software

Comments

Post a Comment