Azimo money transfer

Azimo is an enterprising money transfer business that was launched 8 years ago and has since grown its online service to cover over 200 countries. With around 80 different currencies on offer users can choose from a variety of ways to move their money, including bank deposits and mobile wallets. It’s even possible to use cash, despite the current prevalence of coronavirus putting many off old school paper money.

- Want to try Azimo? Check out the website here

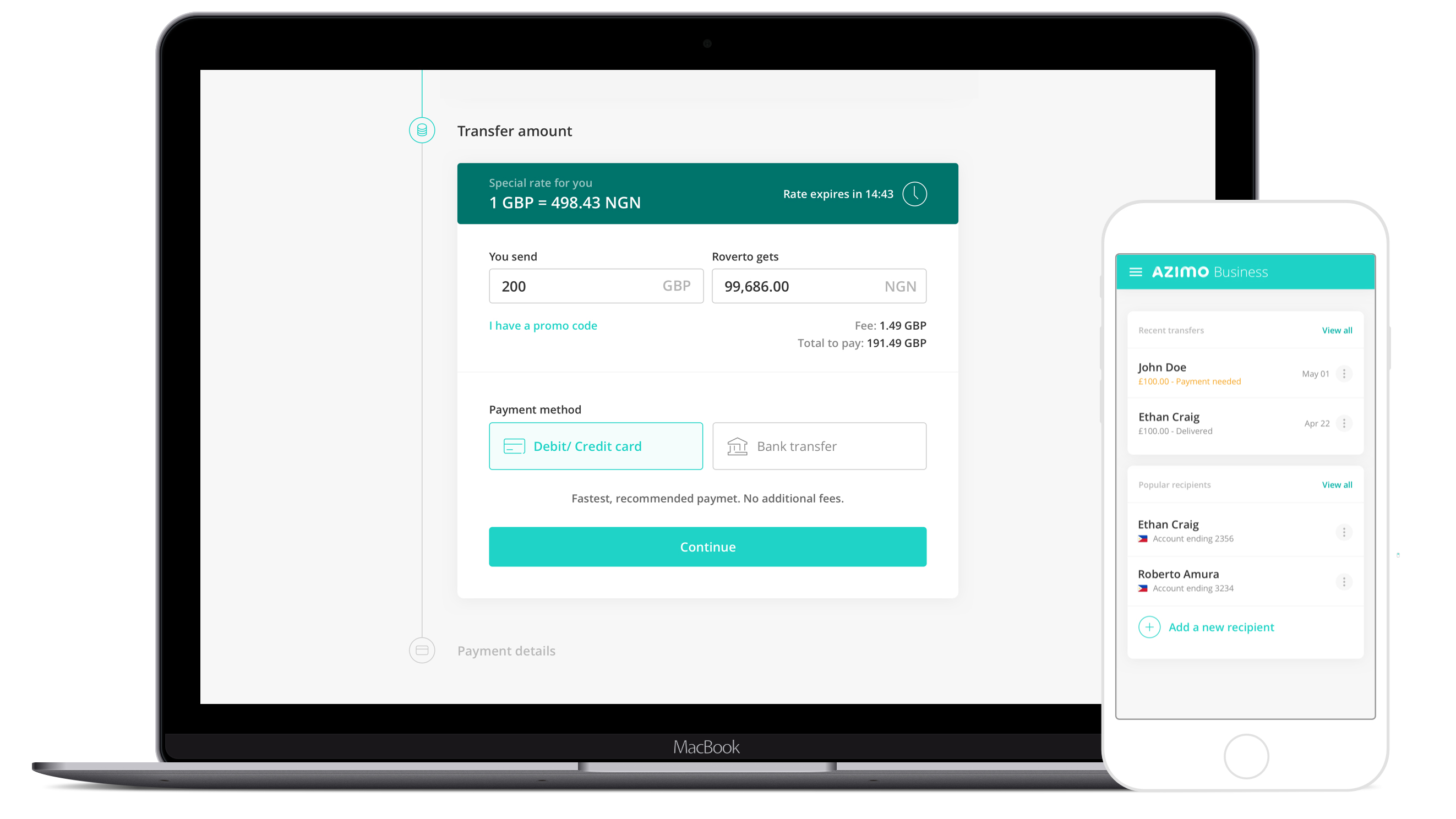

Two years ago Azimo boosted its appeal by developing a money transfer option specifically for businesses, which offers a neat twist on the convenience of sending money around the globe. Azimo Business lets small and medium-sized ventures make use of transfer services that can be less expensive than their banks, while also offering a faster and more efficient service.

Similar products worthy of investigation include WorldRemit, Venmo, Western Union, PayPal and Zelle.

Pricing

Azimo has been designed to be very competitive, especially when it’s put up alongside banks and other well-known money transfer companies who share the same arena. Azimo itself reckons you can save up to 90% compared to the competition, although it’s best to make use of the app as this can give you currency alerts and ensure you get access to the best rates for optimal value.

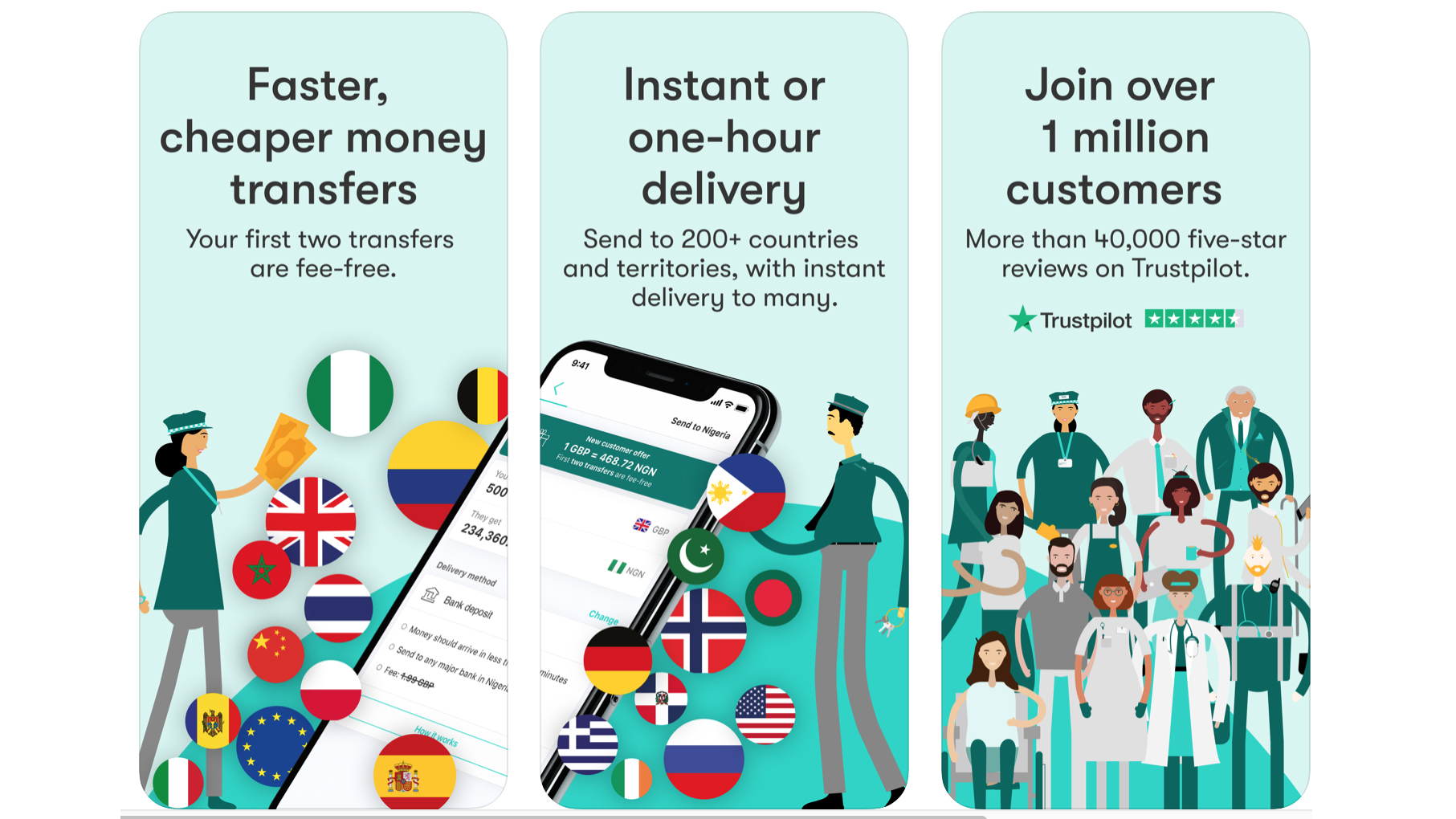

A good way to check if Azimo is any good for your needs is to try it and get the benefit of your first two transfers for free. From there the fees are dependent on where you are sending money to and where it’s being sent from. The delivery method will also have an impact on costs, as will how fast you need to transfer the funds.

Features

We like the no-nonsense approach of Azimo, with its clean lines and straightforward business model allowing you to make money transfers without hassle. Azimo is quick too, with instant or one-hour transfers available to around 80 or so countries. You can also get 24/7 delivery to selected countries, with no weekend delays as Azimo is quick to point out. Getting set up is a simple matter of registering, either as an individual or a business, while the service also gives you two transfers fee-free when you first sign up.

Performance

Overall Azimo seems to have been very well crafted, with the app really sparkling as you pick your way through the straightforward steps for making a transfer. The service packs anti-fraud and encryption technology and is also regulated by financial institutions in the UK (the FCA) and EU.

Going through the transfer process is slick and there’s not much to it either, with registration easy enough, while selecting funds to transfer and paying with a debit or credit card, or a bank transfer if you prefer being all that’s involved to send money. Azimo also does a good job of giving you notifications from their system when the transfer has completed.

Ease of use

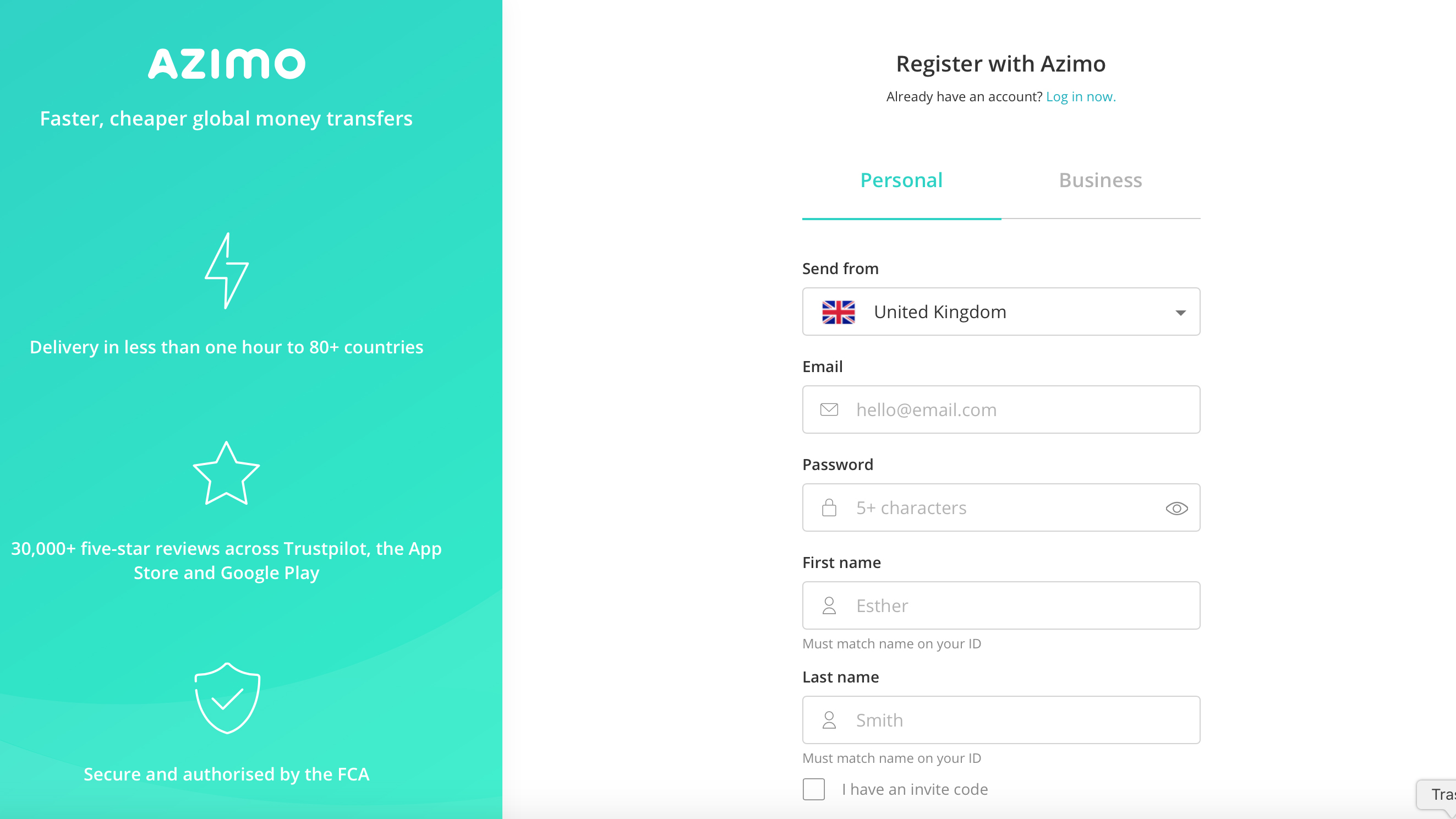

While many of the online money transfer services aren’t exactly difficult or complicated to use Azimo does an even better job of simplifying the process. You will initially need to register in order to make use of Azimo, but that’s straightforward. There are actually two different routes you can take on the registration path, by filling in personal details or registering your business instead.

To get a quick angle on countries you can send funds to it's a good idea to scroll down through the list on the registration page. Useability during the Azimo experience seems to be very impressive, with the desktop web browser route proving clean, simple and fuss-free. The app, meanwhile, makes even more sense as it’s been nicely designed and allows you to carry out and monitor transfers on the go.

Support

There’s an extensive support hub within the Azimo site that can help with every aspect of the money transfer service, from basic guides through to services for business. Azimo also pre-empts many frequently asked questions with its own take called ‘most popular questions’. Perhaps unsurprisingly top of that list is currently an update on Covid-19, but this is also a useful first port of call for other common queries.

If you’re still feeling stumped after a search of the support hub then there are Azimo support staff available Monday to Friday from 9 to 5 UK time. There’s an added bonus in that they have staff that speak English, German, French, Spanish, Portuguese, Polish, Russian and Italian. Most bases seem to be covered in the help stakes.

Final verdict

Azimo continues to impress plenty of people, with says the company, over two million customers to date. There’s certainly plenty to like, with the ease of use and affordability aspects being the main reason to give it a go. Azimo is also regulated in the UK and the EU and has focused on innovations and inventiveness that gives it an additional touch of flair. Face ID and Touch ID security are reassuring, while the app is an impressive piece of software too.

There’s the benefit of in-app customer support in eight languages, which is undeniably useful. The real-time updates on your transfer situation is a practical touch, especially if you’re moving larger sums of cash around. Put it all together and you have a very impressive money transfer package that also keeps costs down.

- We've also highlighted the best money transfer apps

Comments

Post a Comment