CCH Personal Tax

CCH Personal Tax is a tax filing solution for professionals and makes up one of numerous products available from Wolters Kluwer, which has all sorts of applications to tackle tax, accountancy and bookkeeping chores. Along with offering software, Wolters Kluwer also have real people you can deal with. Alternatively, you can enjoy a combination of both software and human experience if that works best for your needs even during the coronavirus crisis.

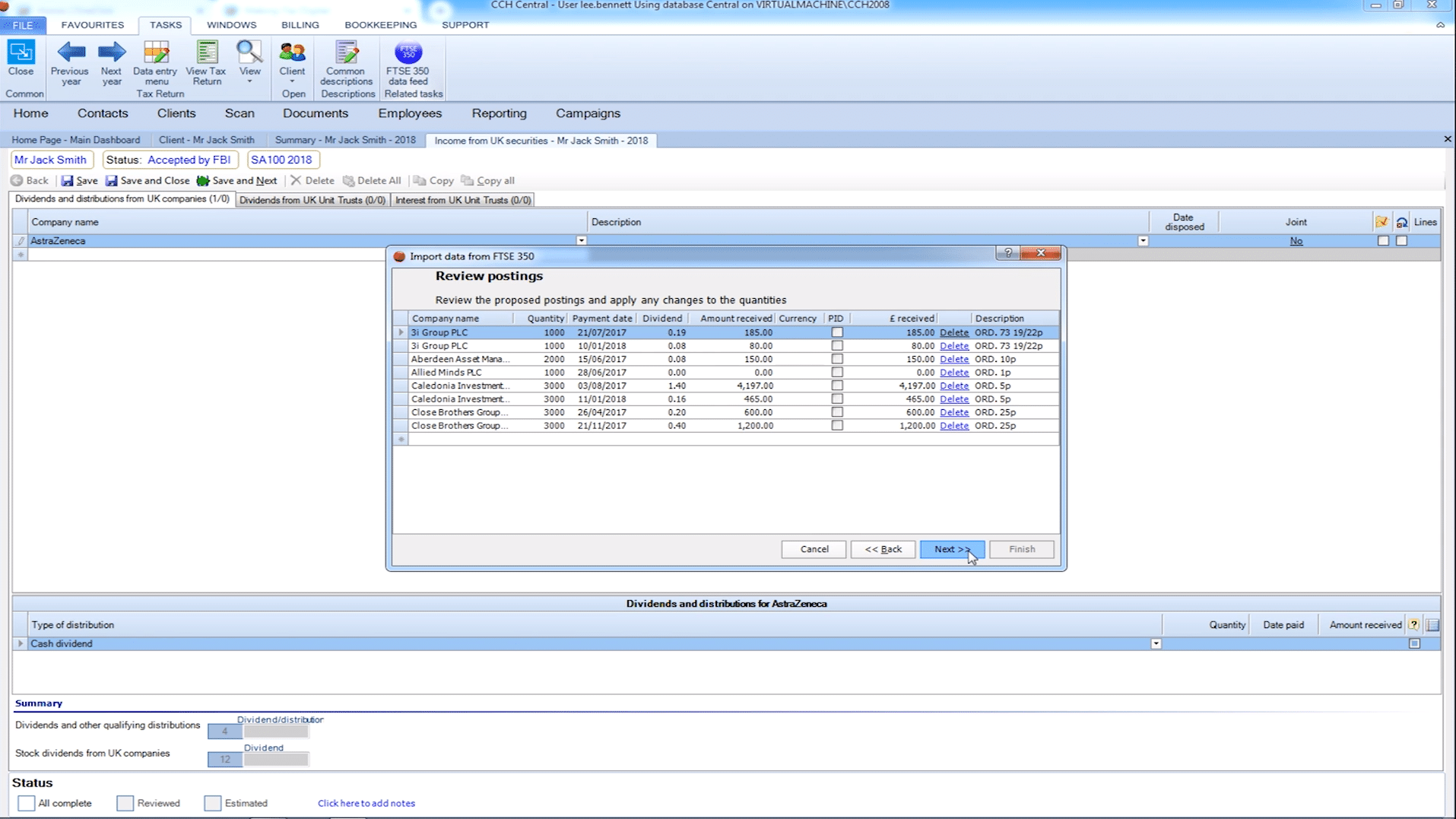

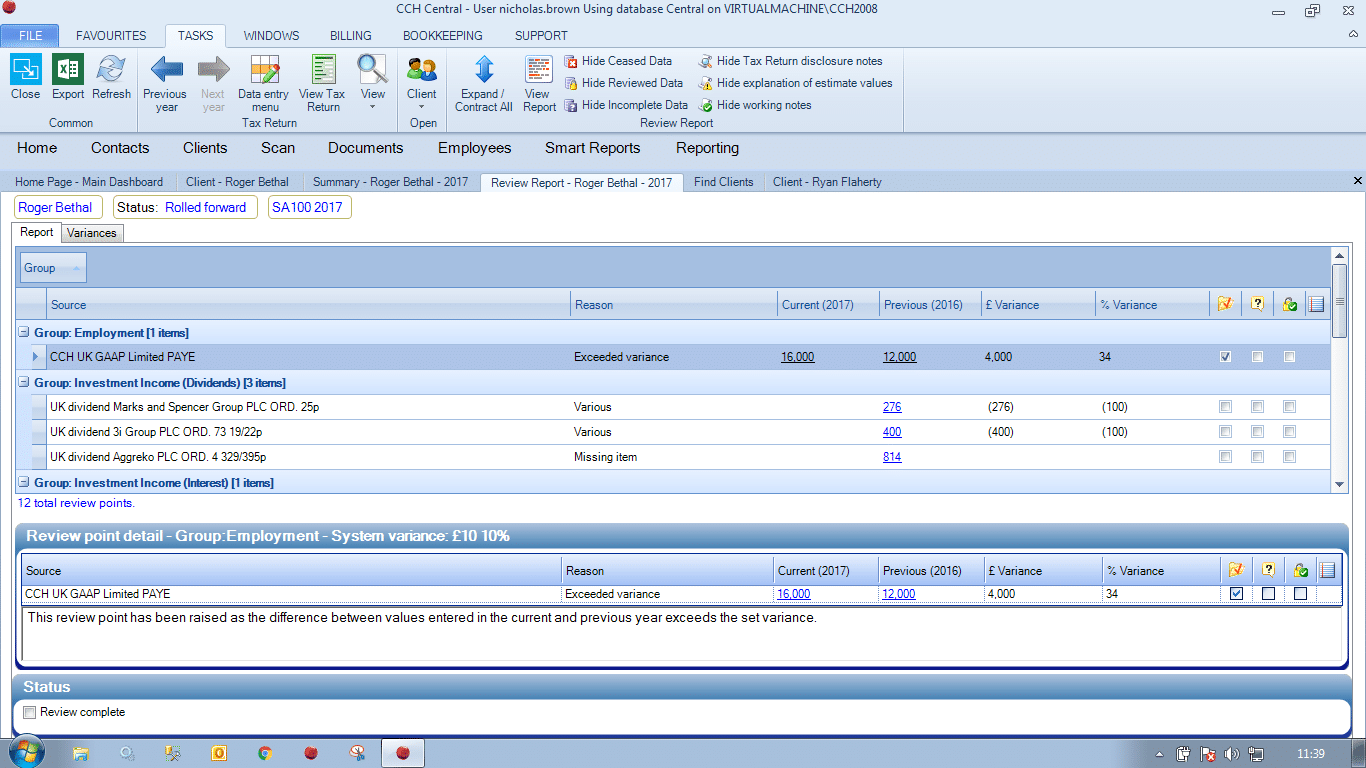

The other bonus is that you can also select additional packages if you have other monetary issues to handle. As such there are the likes of CCH Return Review, CCH CGT & Dividends, CCH Corporation Tax and CCH OneClick to choose from in the portfolio. On its own, however, CCH Personal Tax allows you to enter your tax data, review and finally submit returns online within one streamlined application using a methodical system of templates.

CCH Personal tax sits alongside competitors FreshBooks, QuickBooks, Sage Business Cloud Accounting, Kashoo, Zoho Books, ABC Self Assessment, Xero and Kashflow to name but a few.

- Want to try CCH Personal Tax? Check out the website here

Pricing

While it’s easy to see that CCH Personal Tax comes with a powerful array of tools and functions it’s less obvious how much the experience will set you back. Being more of a bespoke solution, along with the other products in the range, this means that you’ll need to speak directly to the company and get a quote based on your needs.

They can also provide you with a demo of CCH Personal Tax, and presumably the other options in their portfolio, and from there can doubtless tailor a bespoke package to suit.

Features

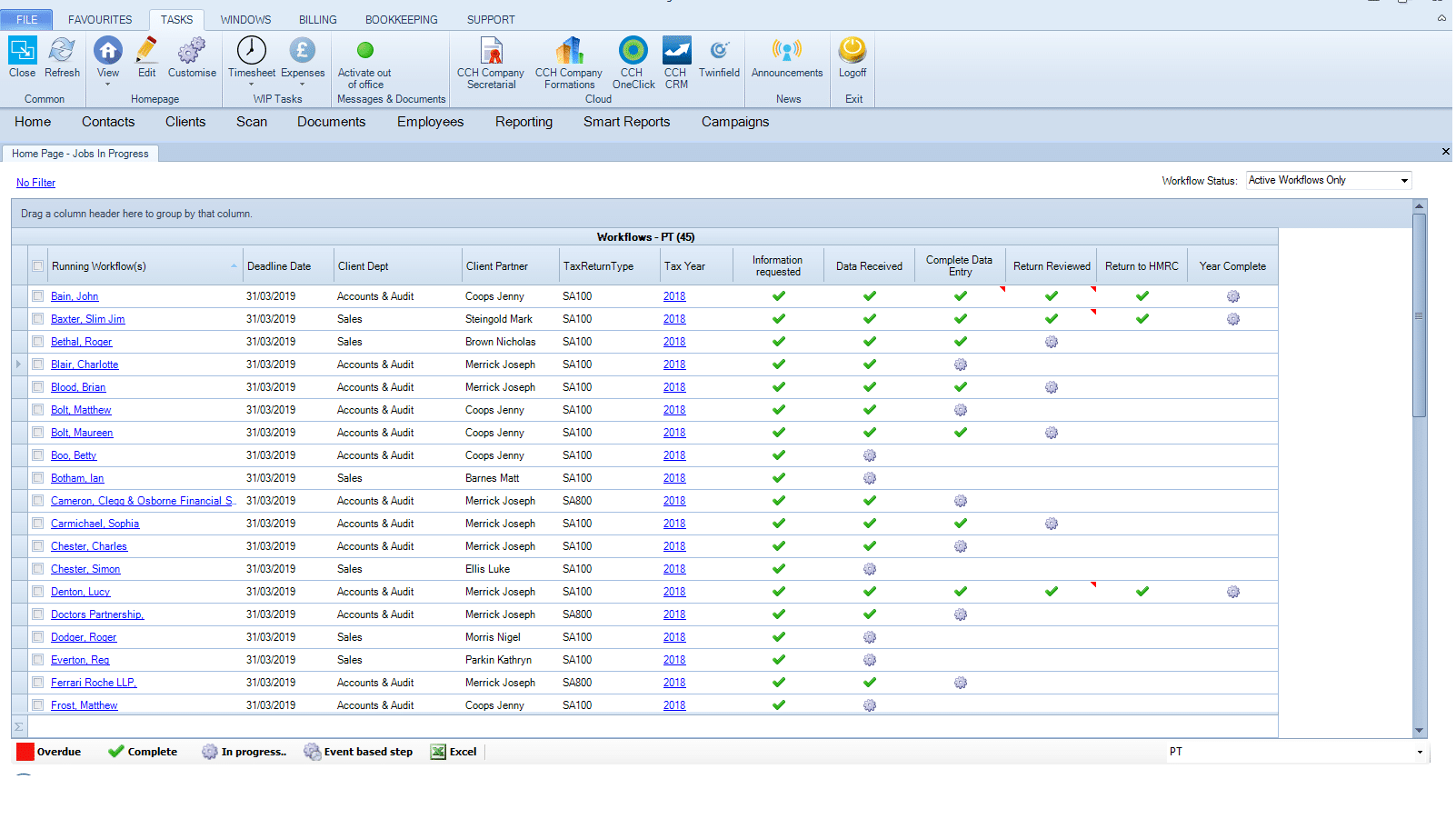

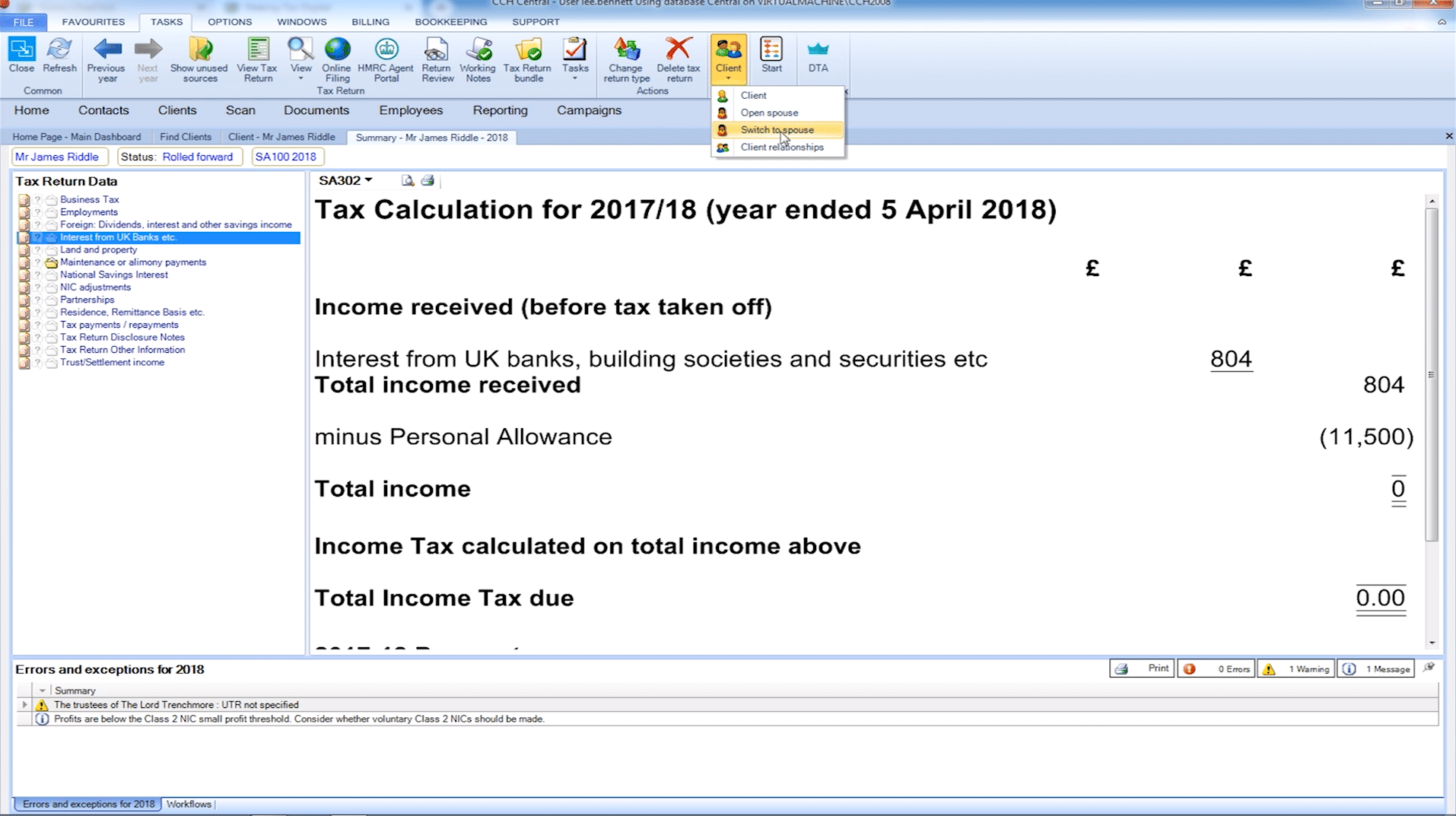

CCH Personal Tax is aimed predominantly at tax filing professionals and accountants who need to work through multiple returns for clients. As a result, its interface has been developed to help work on more than one account at a time, if needed, such as where client accounts are connected or if you need to deal with the tax affairs of a married couple.

It’s also easy to switch back to earlier tax years for quick reference purposes, which will be useful for handling repeat clients. CCH Personal Tax is also built around UK tax returns, with a strong focus on SA100, SA800 and SA900 online filing tasks.

CCH Personal Tax has a live tax computation tool too, which allows you to get a dynamically updated overview of real-time tax figures with every change made. This is a useful tool for working with clients on potential issues that will impact their final return, and a bonus for anyone wanting to work in a tax advisory role.

Ease of use

While the CCH Personal Tax software suite has a lot of tools and functionality, the interface itself is refreshingly easy to navigate. Core options are found in the main menus along the top of your screen, with the whole design having an almost Microsoft Office-style ambience. This will certainly make it less of a threat to anyone not comfortable with handling tax affairs in a web-based environment.

Similarly, hierarchical menus allow quick and easy navigation through the inner workings of CCH Personal Tax. It might take you a while to navigate around all of these routes, but the overall impression is a Windows-style experience that is logical and does exactly what it says on the tin.

CCH Personal Tax also has speedy workflow tools, including the option for bundling tax returns with a covering letter ready to be emailed to clients for final approval.

Support

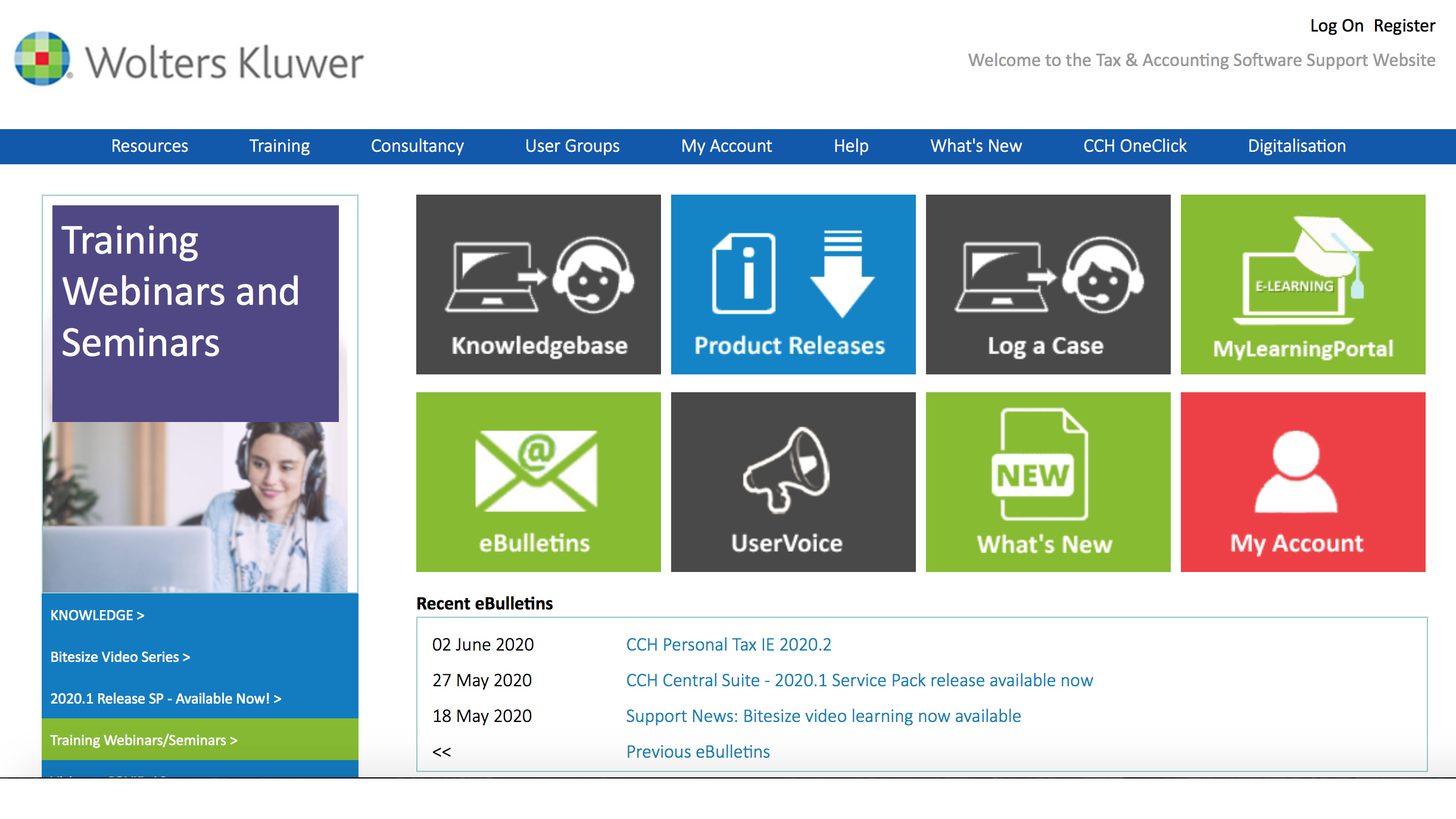

As is often the case with high-end software solutions, buying into the CCH Personal Tax package means that you should also gain access to their support solutions. Even without having to contact them however, you’ll find that their website, plus the accompanying documentation delivers plenty on the basic level support front.

Final verdict

CCH Personal Tax can be used to great effect on its own, but can also be supplemented by other products in the range to help tax professionals provide a complete end-to-end solution. It’s been designed to work for a variety of firms and individuals, from sole traders through to larger business. It can also integrate nicely with the likes of QuickBooks, Sage Business Cloud and Xero too.

Being a professional solution means that pricing is based on tailoring a package to suit your individual needs. While that cost isn't likely to be cheap this professional-level solution is able to meet the demands of any kind of accounting business. Add in the template-based user-friendly interface with a stack of practical tools and you’ve got a solid all-round package.

- We've also highlighted the best tax software

Comments

Post a Comment