TaxAct

TaxAct has had lots of work done to its innermost workings over the last few years and the current version arrives with lots to suit a variety of users. Being an online software solution it follows a similar path to others in the field including TaxSlayer, Jackson Hewitt Online, Credit Karma Tax and FreeTaxUSA, with a step-by-step series of screens that walk you through the hurdles for filing your taxes.

- Want to try TaxAct? Check out the website here

TaxAct has done a sterling job of late too, with plenty of refinements that make the whole process as painless as is realistically possible. If you’re a novice user you’ll still be able to make solid progress in not much time, which is clearly a boon for those of us who procrastinate when it comes to tax return time. TaxAct has also been refreshed to take recent tax reforms into account.

Pricing

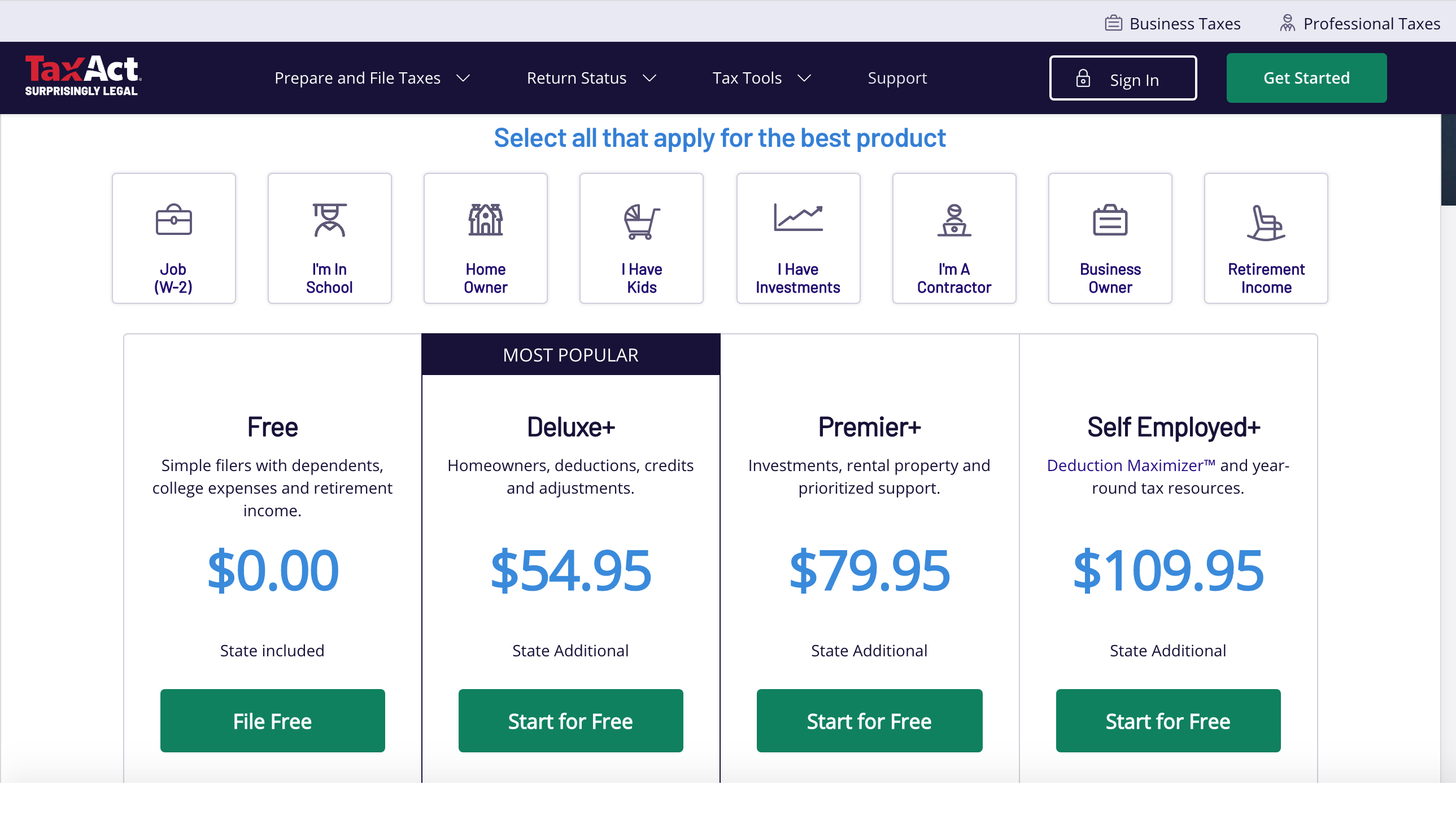

TaxAct’s current pricing structure, which like all of these products and services can change at any time, has something for everyone. Indeed, the TaxAct website gets you off to a great start in that it lets you select various scenarios such as if you have children, have retirement income and investments too.

There are the more obvious considerations too, with the free W-2 jobholders edition (State included) proving ideal if you’ve got fairly basic requirements. The free version also covers filers with dependents and if you have college expenses or retirement income to declare.

Next up, the Deluxe+ package costs $54.95 (+ $54.95 per state filed) delivers everything in the free edition plus more besides. It’s ideally suited to homeowners plus those with deductions, credits and adjustments to file.

The Premier+ model comes in at $79.95 (+ $54.95 per state filed), which includes everything in Deluxe+ with added features for investments, rental property and prioritized support. Top of the tree is the Self-Employed+ package, which for $109.95 (+ $54.95 per state filed) adds on Deduction Maximizer and year-round tax resources.

There are other options too, such as a business specific area of the TaxAct website. In here you’ll find a further four product options, all priced at $109.95 each plus $54.95 per state return. Options include Sole Proprietor covering Form 1040, Schedule C, or Partnership Form 1065, or C Corporation Form 1120 and finally S Corporation Form 1120 S.

Tax Act also does a nice line in bundle deals, where you can combine your individual and business tax software for $200. You can also select downloadable editions of its Basic, Deluxe, Premier and Self-Employed packages too, which cost $26.95, $96.90, $101.90 and $124.90 respectively.

Features

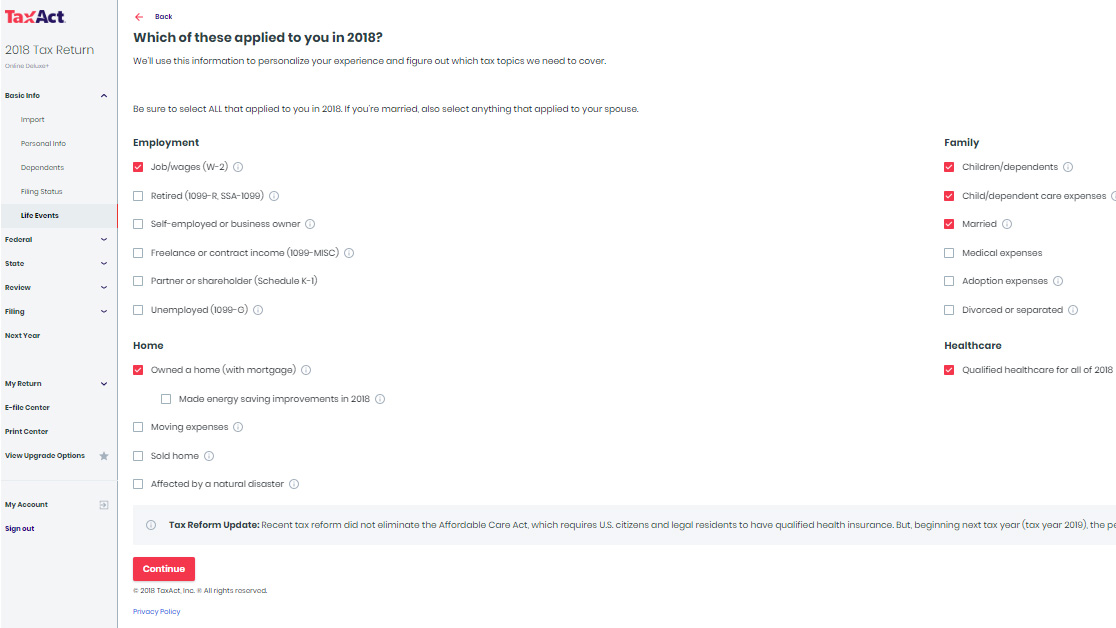

You’ll find that TaxAct comes suitably armed with all of the options for filing, no matter what your tax situation. It’ll welcome Form W-2, the range of Form 1099 variants as well as allowing you to enter business income, rental/royalty income and, basically any other income that is relevant to completing your return in a timely and accurate fashion.

However, while the basic edition is free and offers support for 1040 and retirement income with state returns being gratis, you’ll need to pay for the more powerful feature set editions. Getting the paid for version of TaxAct will arm you with more options, but it can be a little tricky to squeeze the best out of the system, particularly if your tax situation is less than pedestrian.

Ease of use

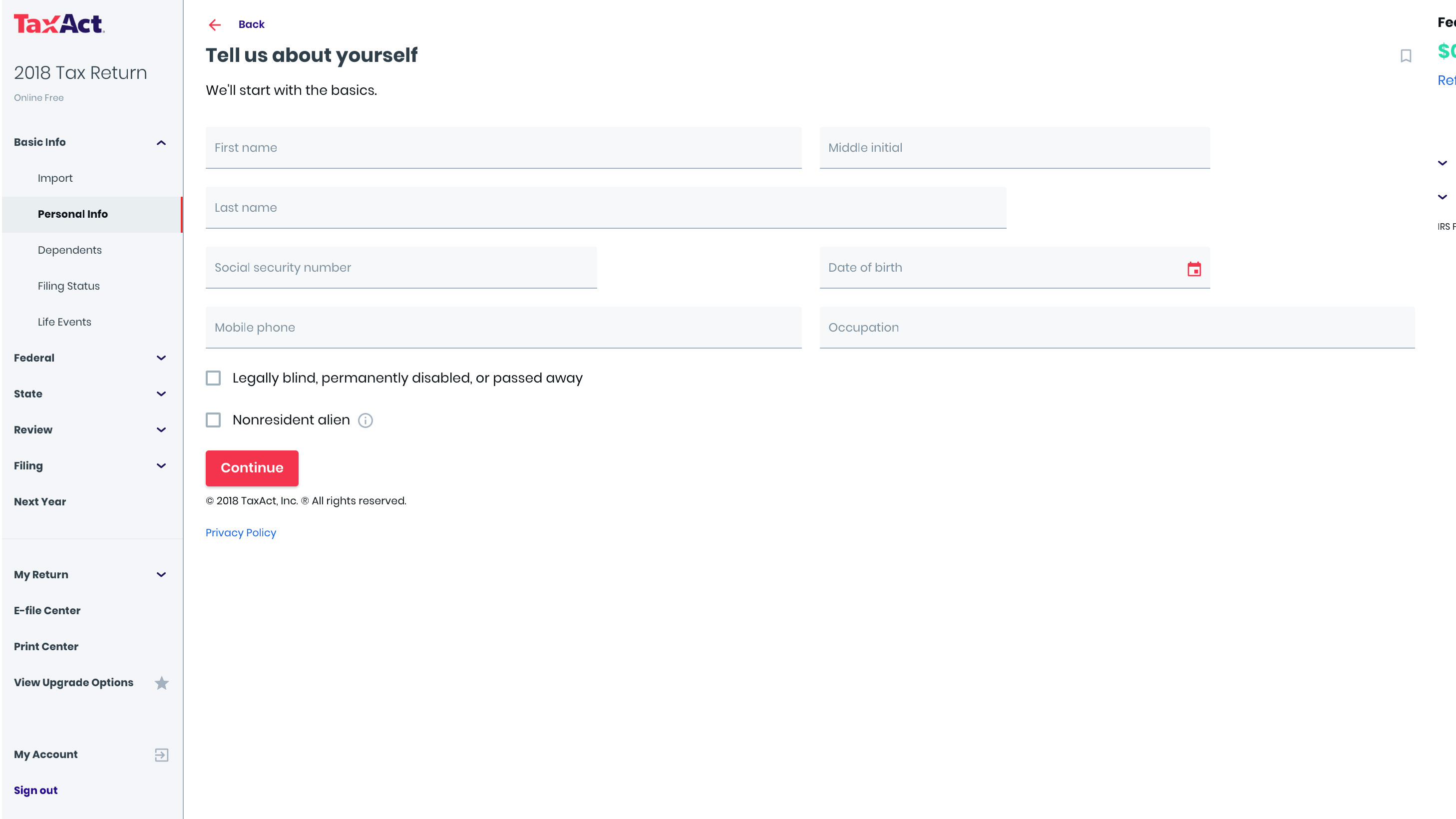

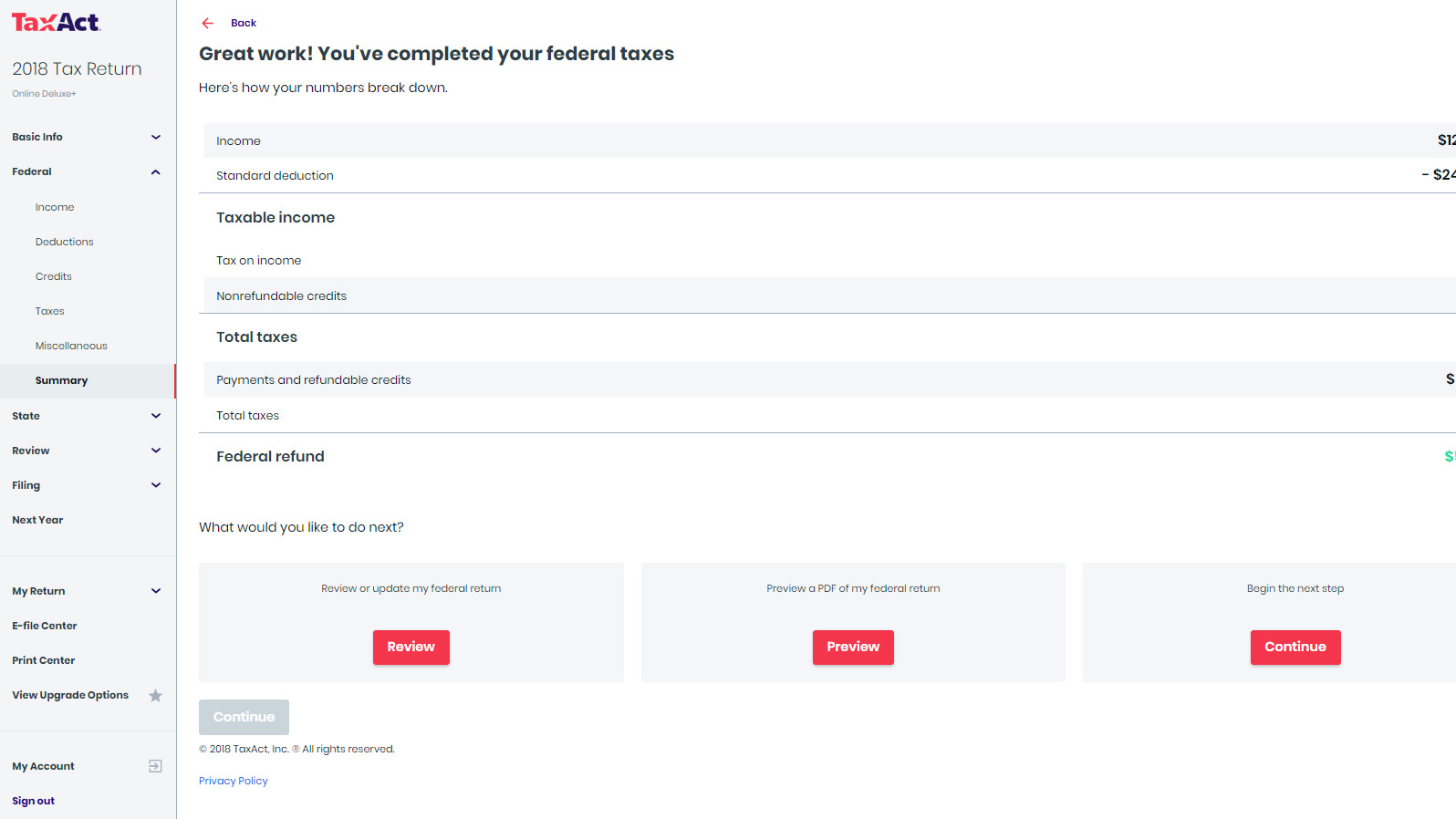

TaxAct is, on the whole, pretty straightforward to work through, especially if you’ve already had experience of using online step-by-step form systems. The hierarchical menu system on the left side of the screen is crisp, clean and very easy to use.

While some of the questioning might prove a little more trying for the less confident, there is also a decent level of help along the way that allows you to master the nuances of TaxAct. Given that the design setup is basically screen after screen, TaxAct has done quite a nice job of making the process workmanlike but, dare we say it, quite good on the eyes too.

Mention should also be made of the app version too, which can work hand-in-hand with the desktop edition so you can switch between the two as and when time allows it. TaxAct is notably for its convenience factor for sure.

Support

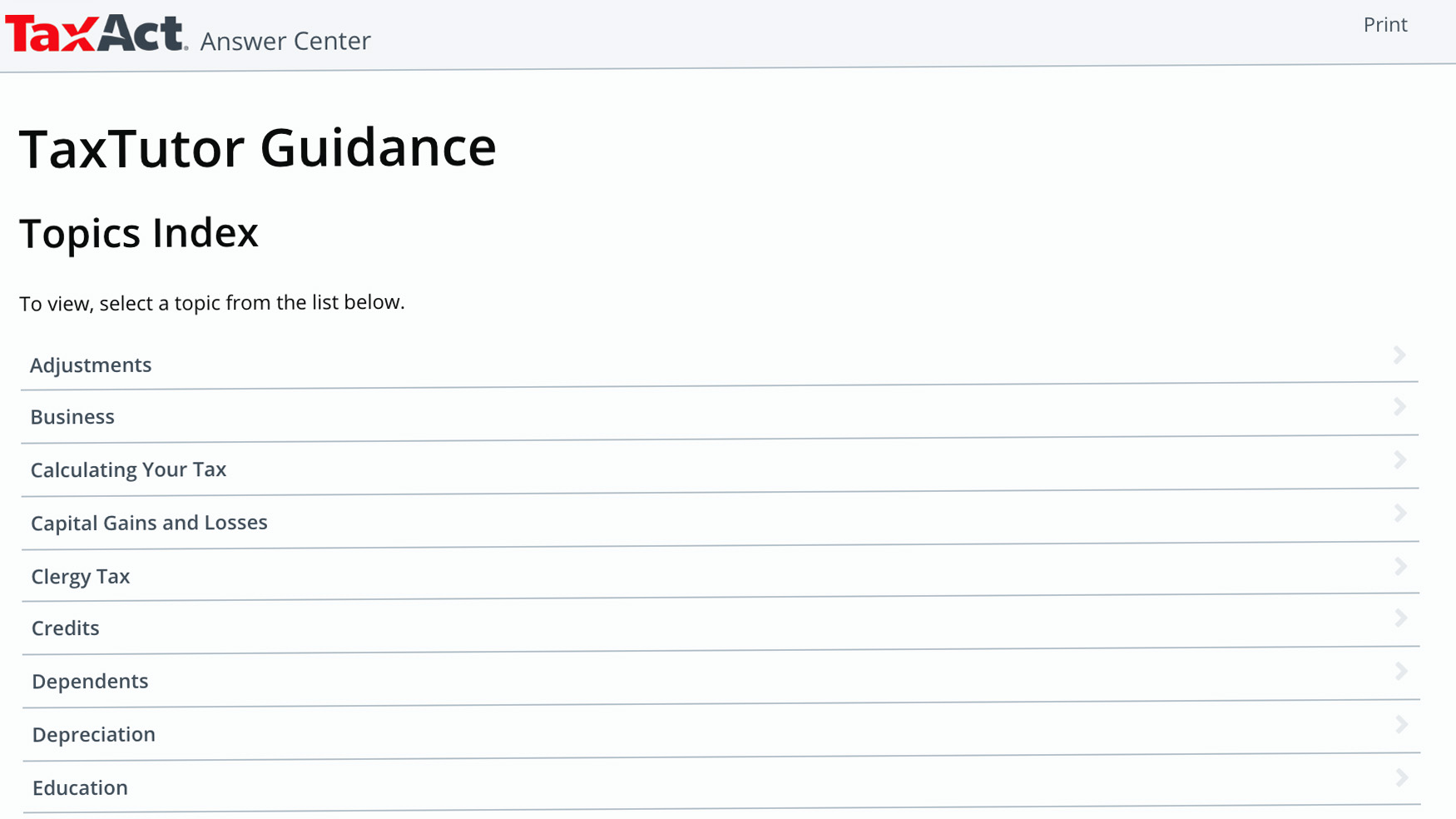

Due to some of the clunkier areas of TaxAct we think that it’s entirely likely you’ll need to call upon the help that’s available within this package. That’s not to sell TaxAct short of course as it’s a potent performer but you might need assistance to get to the final return stage.

Enter then the TaxAct Answer Center, which is a very comprehensive area of the site that has multiple topics that will answer many of your questions and queries. The other benefit with TaxAct is that it has a constant Help and Tools area over on the right side of the page while you work.

Quick and easy access is therefore just a click away. Email support is available across the different editions, while phone support is also on hand towards the filing deadline, details of which can be found on the TaxAct website.

Final verdict

TaxAct is up there with the better online software solutions for filing taxes. The interface and usability have both been tweaked to work better for a variety of different subscribers.

Plus, TaxAct has also been given a once over to bring it bang up to date, which means it covers any and all amendments to the law in recent times. Tax reforms can be difficult to keep up with so it’s reassuring to know that the TaxAct team have that base covered.

That said, TaxAct works best if you’ve got only basic filing tasks to get through, so W-2 jobholders with little in the way of complications should find it a veritable treasure trove as a solution for paying your dues.

- We've also highlighted the best tax software

Comments

Post a Comment